Data from the ABS and NIQ finds Australians are spending less on events, accommodation and food, as inflation and tax hikes raise prices and hit sales in Australia’s clubs, pubs and bars.

Official numbers last week from the Australian Bureau of Statistics (ABS) report the annual rate of inflation rose to 3.8 per cent, up from 3.6 per cent earlier in the year.

Household spending decreased following consecutive rises, falling 0.5 per cent in June after small increases in May and April.

The ABS says this is because people are spending that much less on discretionary items and recreational activities, such as hotel accommodation and eating out.

There has been a 1.8 per cent drop in services spending, and alarming 12.8 per cent decrease in alcohol and tobacco.

New research from CGA by NIQ’s On-Premise Measurement (OPM) service sees a drop in sales volumes across venues.

It says the average price paid for a 425mL glass of beer has increased in the last 12 months by 67 cents or 6.2 per cent, and a 30mL serve of spirits, which is taxed much higher, has risen by 93 cents, or 8.7 per cent.

NIQ reports that since the start of 2022, beer and spirits prices have gone up by 10.5 and 11.8 per cent (respectively).

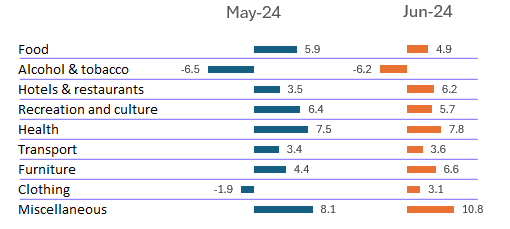

The ABS reports that despite the drop in overall household spending in June, in terms of volume, spending has actually increased six out of the nine categories, with the biggest increases seen in Western Australia and Queensland.

Australia’s Reserve Bank is set to issue a decision this week on whether or not to raise interest rates again, and the latest ABS figures have prompted the Australian Council of Social Service to warn the ABS against another rise.

“The living standards of people on low and modest incomes have been decimated over the past few years, partly due to inflation but also due to higher interest rates,” said acting CEO Edwina MacDonald in a statement.

“The danger now is not this temporary pause in reductions in inflation, but a faster rise in unemployment.

“The cure could become worse than the disease, as the impact of past increases in interest rates flows through to jobs and incomes.”

NIQ’s exclusive service CGA provides analysis of out-of-home drinks trends across Australia, and says price increases and the cost of living crisis have reduced the frequency of people visiting to licensed venues and restaurants.

Its latest Consumer Pulse Report, surveying the habits of On-Premise users, found 43 per cent of consumers were going out less often, contributing to a 7.7 per cent drop in spirits sales by volume in the 12 months to May.

Year-on-year price rises have most affected whiskey (1pc) and tequila (9.2pc), while YOY sales of lower-priced spirits, such as vodka and golden rum, have performed higher than the broader spirits category as some consumers seek value.

Similarly, volumes of beer, malt beverages and cider have increase 1.4 per cent YOY. This may suggest some consumers are switching from spirits to beer, which is often perceived to offer better value for money, but the company says beer sales are also “showing signs of pressure”, declining 3.1 per cent in the three months to May, as compared to the same period in 2023.

On-premise hospitality is a vital part of Australia’s economy, employing more than 900,000 people, according to the Australian Government’s 2023 Labour Market Update Report. Furthermore, it is a vital channel for drinks brands to build equity with consumers; 45 per cent of Australians say the most recent time they tried a new drink was in a venue.

It’s expected sales will be further challenged by the two per cent increase in excise tax on beer, spirit and RTDs, beginning Monday (5 August).

Australia already has the third highest tax on alcohol in the world.

From this month consumers will pay 71 cents excise tax on a schooner of full-strength beer, and $1.25 in tax for a mixed drink.